Search results for #macroeconomics

USD/CHF remains below 0.9100 on the subdued US Dollar, awaits Fedspeak fxstreet.page.link/GZFB #USDCHF #Majors #Macroeconomics #Switzerland

USD/JPY holds ground as Iran plans no immediate retaliation against the Israeli airstrikes fxstreet.page.link/EjFj #USDJPY #Majors #Macroeconomics #Japan

European stocks opened broadly lower, with Germany's DAX down 0.95%, France's CAC40 down 0.84%, Britain's FTSE 100 down 0.44%, and the Euro Stoxx 50 down 0.76%. #AInvest #AInvest_Wire #macroeconomics #price #strategy View more: ftn.ai/T5QG28PSR

Forex Today: Investors seek refuge on reports of Israel attacking Iran – by @eren_fxstreet fxstreet.page.link/9ZTs #Majors #Currencies #RiskAversion #Macroeconomics

GBP/JPY holds below 192.00 following UK Retail Sales data – by @LilyFinancial fxstreet.page.link/a3a8 #GBPJPY #Crosses #RetailSales #Macroeconomics

En marzo, el grupo #mayores45 registró 308.993 #contratos que representan el 28,36% de los contratos iniciales registrados en este mes. Ver más: javiermliron.blogspot.com/2024/04/contra… #edadismo #empleo #macroeconomics #macroeconomia #BusinessIntelligence #paro #data #sepe

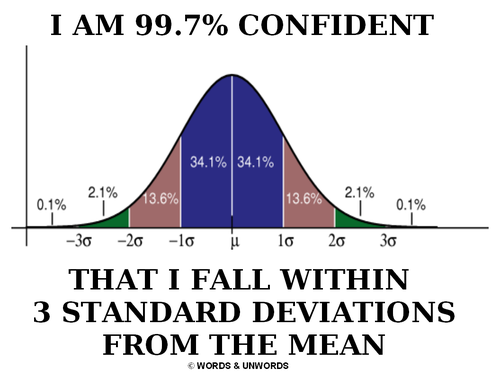

Engage In The Virtuous Cycle Macroeconomics Tee: zazzle.com/engage_in_the_… #engage #virtuouscycle #macroeconomics #macroeconomist #economist #economics #advice #econadvice #economicsteacher #geek #humor #businesscycle #econadvice

NZD/USD remains under selling pressure below 0.5900 amid risk-off mood, renewed US Dollar demand – by @LilyFinancial fxstreet.page.link/zqvE #NZDUSD #Macroeconomics #Majors

USD/CAD trims gains after Iranian media denies any attack, remains below 1.3800 fxstreet.page.link/xVpY #USDCAD #Majors #Macroeconomics #Canada

Australian Dollar depreciates as riskier assets fall on escalated tensions in Middle East fxstreet.page.link/RtgM #AUDUSD #Macroeconomics #Majors #Australia

USD/INR strengthens amid Iran airport attacks and oil prices rise – by @LilyFinancial fxstreet.page.link/fwQU #USDINR #India #EmergingMarkets #Macroeconomics

Iran IRGC states that Iran will target Israeli nuclear sites with counterattack #AInvest #AInvest_Wire #macroeconomics #world #precious View more: ftn.ai/TE7H4BBQB

Gold Price Forecast: XAU/USD rises above $2,410 after reports of Israeli attack on Iran fxstreet.page.link/AKEh #Gold #XAUUSD #Macroeconomics #Commodities

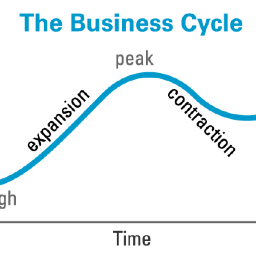

In the past, people were claiming, Is #macro influencing the market? Is #macro important to look at? Is #recession likely to come? And now, the eyes are all in on #macroeconomics and #recession. I guess this is how cycles work with the market's emotions.

AUD/JPY extends losses after Japan CPI figures amid dovish RBA’s outlook fxstreet.page.link/K5Ng #AUDJPY #Crosses #Macroeconomics #Japan #Australia

Japan's Nikkei 225 stock average extends drop to 3%. #AInvest #AInvest_Wire #macroeconomics #strategy #budget View more: ftn.ai/T9RHEMDE7

The sharp run from 105.00 has posted a fresh year high at 105.37. View the chart at ow.ly/b1qs50ReU3r --- #assetmanagement #financialmarkets #macroeconomics #capitalmarkets #economy #technicalanalysis #USD #DXY

GBP/USD remains on the defensive below 1.2450 ahead of UK Retail Sales data – by @LilyFinancial fxstreet.page.link/86GT #GBPUSD #Majors #Macroeconomics

Japan inflation: National CPI climbs 2.7% YoY in March vs. 2.7% expected – by @LilyFinancial fxstreet.page.link/W9d9 #Japan #CPI #Macroeconomics #Inflation

Centre For Macroecono.. @CFMUK

7K Followers 31 Following The Centre For Macroeconomics brings together world class economists to study the global economic crisis and propose policies to prevent future crises.

Rebuilding Macroecono.. @RebuildMacro

9K Followers 2K Following Previously funded by @ESRC & part of @glo_pro @ucl - we support new & interdisciplinary #research to make #macroeconomics relevant to 'real-world' issues

International Macroec.. @imtcd

1K Followers 272 Following Official twitter account of the International Macroeconomics (IM-TCD) research group at the Department of Economics of Trinity College Dublin

Macroeconomics MOOC @macromooc

731 Followers 23 Following All of us are affected by macroeconomic forces – they shape the very world we live in.

Structuralist Develop.. @SSdmrg

497 Followers 102 Following Structuralist Development Macroeconomics Research group https://t.co/k52MgRj1sj

Laboratory for Macroe.. @rseLaMP

146 Followers 14 Following Laboratory for Macroeconomics and Policy @EconomicsANU | @ANU_Cbe An Open Macro and Policy ColLaboratory Research Community

Forum Applied Macroec.. @FAppliedmacro

2K Followers 1K Following All on applied macroeconomics topics and tools. Mention @FAppliedmacro for questions or signaling papers. Admin @Mariosa_Com. Check the website!

Afrifem Macroeconomic.. @NawiAfrica

3K Followers 1K Following Building a community of PanAfrican feminists working to deconstruct and reconstruct Macro level economic policies.

Ugur Alkan @vvitru

39K Followers 779 Following Ex-academic @METU_ODTU Later full scholarship PhD @UniofAdelaide (dropped) Now macroeconomics and financial markets enthusiast Bilingual account

The 6th Conference on.. @lawmacro

179 Followers 18 Following Conference on November 2-3, 2023 at Tulane Law School

Orhan Karaca @Dr_OrhanKaraca

18K Followers 651 Following Associate Professor of Macroeconomics https://t.co/CJWx3uhUbE

Macroeconomics @econolion

63 Followers 1 Following

Seminar in Macroecono.. @macro_hit_u

149 Followers 1 Following 一橋大学経済研究所は,京都大学経済研究所マクロ経済学・経済システム研究会とマクロ経済に関する研究セミナーを主催しています. このアカウントはそのマクロセミナーの公式アカウントです. 参加希望者は次のURLからGoogle Formを記入し,登録してください. https://t.co/yGuE32pZlO

slickenteur @slickenteur

22K Followers 164 Following Reader, Ruminator, Commentator; Interested in Macroeconomics and Polity; Passionate about Wildlife Conservation; Avocation: Sports

Ceyhun Elgin @CeyhunElgin

29K Followers 2K Following Macroeconomics Prof. Worked/working @nyulangone @columbia, @BU_Tweets, @MinneapolisFed / @unibogazici, @aubgedu. Co-owner @riskfin_ltd, Director @kayitdisiekon

Chair of Macroeconomi.. @mip_ethz

198 Followers 51 Following Chair at @ETH_en Zurich, led by Prof. @hans_gersbach.

Deer Point Macro @deerpointmacro

25K Followers 2K Following Macroeconomics, emerging and developed markets, FX, covered interest rate parity, and cross-currency basis swaps.

Philipp Heimberger @heimbergecon

58K Followers 762 Following Researcher, Vienna Institute for International Economic Studies (@wiiw_ac_at); political economy, economic policy, macroeconomics, public finance.

Latha Venkatesh @latha_venkatesh

441K Followers 383 Following Executive Editor @CNBCTV18News ; interested in markets and macroeconomics

Ninja News @ninjanewsio

14K Followers 6 Following Ninja News is a leading digital media platform offering comprehensive coverage of cryptocurrency, blockchain, NFTs, metaverse, and macroeconomics.

Iktisat Medresesi @AhmetETayyar

4K Followers 82 Following Marmara Uni | Economic Theory, Uludağ Uni | Economic Policy, ÜAK | Assoc. Prof. Macroeconomics, ÖSYM'ye Soru Değiştirten Hoca! (2023-34, 2022-60)

Will Schryver @imetatronink

102K Followers 192 Following Geopolitics - History, Empires, and War - Macroeconomics and Markets - Music - Photography English / Italiano

RMIT Macroeconomics @rmitecon1010

40 Followers 12 Following

Tascha @TaschaLabs

170K Followers 114 Following Crypto & web3 through macro lens. PhD macroeconomics. Angel investor. Startup advisor. Founder https://t.co/LlYvU0aA5H.

srmg Think @srmgthink

2K Followers 4 Following MENA-focused independent research & advisory firm. Experts from UN, World Bank, & more. Specialized in energy, geopolitics, macroeconomics. Born out of @SRMG_HQ

Australasian Macroeco.. @AustralianMacr1

107 Followers 37 Following Official twitter account of the Australasian Macroeconomics Society

MacroVoices Podcast @MacroVoices

70K Followers 96 Following The premiere weekly financial podcast, with hedge fund manager @ErikSTownsend, interviewing the brightest minds in finance and macroeconomics.

Rob Kientz | Gold Sil.. @goldsilver_pros

47K Followers 213 Following 🔶 GSPros Bullion Store Owner | Texas 🎙️ Weekly videos on Macroeconomics, Freedom, and Precious Metals Markets.

Macroeconomics @StudentInvestR

604 Followers 2K Following Student of macroeconomics.Developing a model that explains the relationship between Twitter, output, consumption, inflation, savings, investment, international.

Ahmed Jamal Pirzada @ajpirzada

10K Followers 546 Following Economist at @BristolUni. Interested in macroeconomics. Retweet is not endorsement. From #Bhera/#Islamabad!

e-recep @irecep2

1K Followers 192 Following Hell is other people. Trends - Macroeconomics as a hobby - Liberty over Security - Liberty over Equality

Zafer Doğukan Cincil @zafercincil

2K Followers 478 Following TU München Politics & Technology, Koc Uni Electrical Eng. & Economics, Macroeconomics enthusiast, Owner/Lead @barcauniversal @madriduniversal

Madelon Vos @MadelonVos__

76K Followers 2K Following Follow me to learn about #Bitcoin #Macroeconomics, #CentralBanking, #Investing & #Inflation▫Madelon Vos on YouTube (100K+ subs)▫️ Ex host @BNR

Ben Moll @ben_moll

25K Followers 1K Following Professor of Economics, @LSEecon. Macroeconomics with distribution(s).

Marcel Fratzscher @MFratzscher

73K Followers 941 Following President of @DIW_Berlin, Professor for Macroeconomics at Humboldt University, and Op-Ed columnist Zeit Online.

Jagjit S. Chadha @jagjit_chadha

4K Followers 57 Following Director. National Institute of Economic and Social Research. Macroeconomics. Business Cycles. Commentary.

Modern Day Philosophy @DeanMichealsMDP

6K Followers 165 Following Just trying to make a difference | MACROECONOMICS | Trading Psychologist | DM for Mentorship and Private Sections | CONSULTANT

Real Time Macroeconom.. @RealTimeMacro

125 Followers 365 Following Real Time Macroeconomics is a dashboard that provides real-time macroeconomic data.

Michele Tertilt @TertiltMichele

3K Followers 169 Following Professor of Economics, Family Economics, Macroeconomics, Consumer Finance, HIV Research

Andreas Peichl @APeichl

12K Followers 3K Following Professor of Economics @LMU_Muenchen, Director @ifo_Institut's Center for Macroeconomics & Surveys; #Taxation, #Inequality, #Data, #SGE, #Blackhawks, #firstgen

Sabyasachi Kar @Sabya_K

4K Followers 181 Following RBI Chair Professor, Institute of Economic Growth | Editor (Macroeconomics), Journal of South Asian Development | Economics | Political Economy | Indian Economy

Banking, Financial Ma.. @MarketsandMacro

69 Followers 207 Following Questions, insights and primers on banking, financial markets and macroeconomics

Passed Pawn @passedpawn

5K Followers 1K Following Macroeconomics and Markets, Hedge Fund Mgr, Market-Maker, Venture Investor / Chess Master / @MIT engineering

xAlex @alexd1a

2K Followers 284 Following Macroeconomics and geopolitical views ! Stocks and crypto investing + trading 📊

Macro Economics @_macroeconomics

18 Followers 0 Following

redge @redgenkosi

7K Followers 588 Following Firstsource Money: Policy Research & Advisory - Money, Banking & Macroeconomics #Macroeconomics #Banking #Money #DevEcon

Pakistam Macroeconomi.. @PMacroeconomics

29 Followers 182 Following

Pedro H Dejneka @PHDChicago

8K Followers 504 Following Papai & husband 1st! Founder/Partner @ MD Commodities. South America/World agricultural commodities & macroeconomics analysis - Basketball lover & Coach 🤙🏻

Morten O. Ravn @MortenORavn

6K Followers 399 Following Professor of Macroeconomics. Arsenal and Fiorentina. @[email protected]

Ian Shepherdson @IanShepherdson

30K Followers 1K Following Chief Economist, Pantheon Macroeconomics. A 'danger to the world', according to some Twitter guy. For a Pantheon trial: https://t.co/hjv4yzlxDl

Eric Tymoigne @tymoignee

6K Followers 535 Following Economist @lewisandclark @LevyEcon (Macroeconomics, Money, Finance, Political Economy). (MOSTLY INACTIVE AND RARELY CHECKED, Email for Qs: [email protected])

Dirk Ehnts @DEhnts

9K Followers 2K Following Economist/Ökonom, "MMT: A Simple Explanation of the monetary system" (Springer 2024), „Makroökonomik“ (2023), "MMT and European Macroeconomics" (2017), #MMT 🦉

Simone Tagliapietra @Tagliapietra_S

11K Followers 4K Following Senior fellow at @Bruegel_org. Professor at @SAISHopkins. Author of 'Global Energy Fundamentals' and 'Macroeconomics of Decarbonisation' at @CambridgeUP.

Macroeconomics @TradingWithEcon

16 Followers 28 Following Some of us are building from scratch - no inheritance, no connections, no backups, nothing... just blood, sweat, and skills!

B. Weder di Mauro @bweder

3K Followers 203 Following President of CEPR, Professor of International Macroeconomics, Distinguished Fellow Emerging Markets Institute, INSEAD

Christian Valente @cvalente28

9K Followers 536 Following Investor and lover of Stoicism. I study Macroeconomics and Markets. I trade and am fascinated by human behavior. I also am a humorist. Lover of freedom. 🇺🇸

Dennis Novy @DennisNovy

4K Followers 651 Following Professor of Economics at University of Warwick, @CEP_LSE, @CEPR_org. International trade, macroeconomics, finance. Former advisor HM Treasury, House of Lords.

wiiw @wiiw_ac_at

5K Followers 3K Following Vienna Institute for International Economic Studies. Macroeconomics, Labour, Inequality, Migration, Trade & more. Focus on Central, East & Southeast Europe.

Top Gun Financial @TopGunFP

2K Followers 296 Following Greg Feirman (CEO) Registered Investment Advisor (RIA) Macroeconomics/Value Investing/Growth Investing/Technical Analysis MA/BA Philosophy

Julia Braga @juliambraga

15K Followers 2K Following *Associate Professor, UFF. *Co-editor, Review of Keynesian Economics. *Undersecretary for Macroeconomics and Commercial Policy, MoF.🇧🇷

The Secret Muslim Ban.. @SecMuslimBanker

3K Followers 353 Following Managing a $100m investment fund. Breaking down macroeconomics with Islamic finance. Sharing my journey and insights on creating a riba-free economy.

Prime Economics @primeeconomics

10K Followers 1K Following Policy Research in Macroeconomics (PRIME) is a network of professionals from related disciplines who seek to de-mystify economic theories, policies and ideas.

Ironsides Macro @barryknapp

9K Followers 656 Following Ironsides Macroeconomics LLC. Macroeconomic & public policy strategy I'm not joking. This is my job. Podcast: https://t.co/RDQlWX61FE…

Luca Fornaro @LucaFornaro3

6K Followers 718 Following Researcher @CREIResearch, working on international macroeconomics.

Matteo Maggiori @m_maggiori

10K Followers 488 Following Economist working on international macroeconomics and finance. Prof at @Stanford University GSB. Co-founder https://t.co/p0YhdXIWon @GCAProject

Peter Doyle @retepelyod

2K Followers 380 Following Global macroeconomics/politics/agency/warming. Here (and there … https://t.co/R6lvGSptD0) to talk straight, not to stroke egos. NIESR visitor.

Emil Verner @EmilVerner

4K Followers 620 Following Economist at MIT Sloan working on finance, international economics, macroeconomics, and other fun stuff

Macroeconomics1A @Macroeconomics1

12 Followers 0 Following This is where you can ask questions regarding Economic 1A and help from other students! Communicate and make your Econ life easier.

Ally Braun 🇺🇸 @realallybraun

2K Followers 864 Following Mom First 👩👦- Patriot 🇺🇸 - LEO Fam 💙 - Salt Life ⚓️- Realtor 🏠 - Small Business Owner 🛒 - Obsessed w/ Macroeconomics & Trends 📈

Amanda Michaud @mander_michaud

3K Followers 455 Following Senior Economist @MinneapolisFed, formerly @WhiteHouseCEA , IU, frb-stl, & Western. Aroostook born. Loves 🐶,🏃♀️, & macroeconomics. Views my own.

Joy Liu @heyjoyliu

2K Followers 191 Following I’ve got a YouTube channel talking about economics in Chinese and English

A Primer on Macroecon.. @Primer_on_Macro

67 Followers 162 Following The feed to follow with the textbook. See links to the book on Google Play and the associated blog on the website below.

Matthias Doepke @mdoepke

8K Followers 983 Following Family economics and macroeconomics @LSEEcon. Coauthor of "Love, Money, and Parenting" https://t.co/bofV9mIhNE…

Alvaro Ortiz | @BBVAR.. @alvaroortiz1968

9K Followers 4K Following Head of Big Data & AI Economic Analysis BBVA Research & Adjunct Professor at IE Business School. Economics,Big Data & Applied Geopolitics. PhD Ec.& Kiel ASP.

Daniel Takieddine د�.. @DaniTakieddine

45K Followers 25K Following Interested in Macroeconomics, trading , quotes, books

Samuel Tombs @samueltombs

13K Followers 1K Following Previously Chief UK Economist at Pantheon Macroeconomics. Now joining the US team at Pantheon.

Tim Kehoe 🇺🇦 @TimTkehoe

17K Followers 5K Following Professor of Economics, U. of Minnesota: General Equilibrium, International Trade, Macroeconomics, Latin America. He/him. @UMNews @IDEA_UAB @uvigo @ITAM_mx

Randy Paynter @paynter

14K Followers 452 Following Serial entrepreneur, proud father, tech, environmentalist, behavioral economics and macroeconomics nerd

Francesco Saraceno @fsaraceno

8K Followers 2K Following Italian economist #EMU #Euro #Macroeconomics #Policy Bluesky: https://t.co/nJKDuK5vMu #DiarioEuropeo per @DomaniGiornale Io ci metto nome e cognome. Voi?

Ali Oktay @alioktay48

624 Followers 400 Following Steel trading Commodities enthusiast Metals & Energy Macroeconomics

Christian Wolf @ChristianKWolf

4K Followers 462 Following Assistant Professor @MITEcon. | Macroeconomics, Econometrics.

Darren Quinn | Modern.. @AusMMT

2K Followers 450 Following I am a self-taught economist championing MMT macroeconomics. I am on a crusade for public economic enlightenment, even the experts can't resist my wit.

Eran Yashiv @eranyashiv

235 Followers 74 Following Professor of Economics at Tel Aviv University and member of the Center for Macroeconomics at the London School of Economics (LSE)

Neil Mehrotra @neilmehrotra

2K Followers 235 Following Assistant Vice President and Policy Advisor at the Minneapolis Fed. Former Deputy Assistant Secretary for Macroeconomics at US Treasury. Views are my own.

Fatih Kaynarca @kaynarcatr

3K Followers 618 Following Board Advisor @repieportfoy, Founder @kaynarcalaw, International Commercial Law LL.M @citylawschool, Macroeconomics and financial markets enthusiast.

AIU Macroeconomics @AIU_Macro

8 Followers 2 Following

Gavyn Davies @gavyndavies

24K Followers 264 Following Gavyn Davies writes on macroeconomics and the markets. He is Chairman of Fulcrum Asset Management, formerly Goldman Sachs chief economist and an FT columnist.

Hoozhi Trades @HoozhiBoy

3K Followers 2K Following All posts are my opinion, not financial advice Option swing trading 👑. #Stocks #options #Investing Subscribe to my YouTube or IG! @HoozhiTrades #Macroeconomics

Pouya M @mirmahboub

1K Followers 806 Following Iranian American trying to find common grounds in politics, make sense of macroeconomics, and be a responsible citizen. Tweets are in both English and فارسى

JC Collins @HigherManas

31K Followers 3K Following Geopolitics, macroeconomics, crypto, philosophy, history and resource mining. The world is restructuring itself in our lifetime. Understand the change.

Harald Uhlig @haralduhlig

10K Followers 611 Following Specialty: macroeconomics. I am professor at the dept. of economics of the University of Chicago,

Antonio Coppola @acoppola4

1K Followers 173 Following Assistant professor at @StanfordGSB. Economist working on international macroeconomics and finance.